While this works well for small businesses with limited staff, companies anticipating rapid growth or needing multiple accountant or bookkeeper seats may find the cost of scaling a drawback. Automatic daily bank feeds in Xero optimise financial tracking by automatically importing transactions from bank and credit card accounts into the software each day. This feature eliminates the entry of manual data to ensure that financial records are consistently up-to-date and accurate. In addition, it simplifies the reconciliation process by allowing users to quickly match transactions with their Accounting records. Xero Accounting Software is an innovative Cloud-based Software for small to medium-sized businesses and Accountants.

- The platform particularly excels for businesses with multiple employees, remote teams, or those requiring collaboration with external accountants and financial advisors.

- QuickBooks is specifically designed for US-based businesses, offering alignment with Generally Accepted Accounting Principles and direct integration with US tax-filing systems.

- You can even reconcile bank accounts and convert quotes to invoices.

- Users report saving an average of 5.5 hours per week through these automated processes.

- Our editors thoroughly review and fact-check every article to ensure that our content meets the highest standards.

- It takes quite a while to explore all of the features it has to offer, but once you get acquainted with the software, Xero is fairly easy to use.

Bank connections

This is really helpful for getting some How to Invoice as a Freelancer immediate insights into your business’s financial performance. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. All three plans come with an optional add-on for payroll with Gusto for $40 per month plus $6 per month per person. Discover seamless app integrations for efficient accounting with Xero’s comprehensive accounting software.

👍/👎 Customer service

While live chat and general phone support are not available, the callback option ensures you are connected with the most knowledgeable team member for your issue. Discover this year’s updates designed to help you save time, featuring powerful new tools and features you might’ve missed. From streamlined bank connections to intuitive online invoicing, Xero’s features empower you to prioritize business growth. While my overall experience of using Xero was positive, I noticed some platform limitations.

Manage supplier bills

Explore Xero’s range of features, designed to streamline your accounting needs. Xero does not offer live chat support either, which could have helped users who need instant solutions. However, it has an active community forum and a collection of support articles that are beneficial to the users. When I contacted Xero with a login issue, I got a delayed reply, which could have been resolved sooner. This is not an offer to, or implied offer, or a solicitation to, buy or sell any securities.

- Xero is robust, cloud-based software with strong accounting, ample integrations, and some great features.

- Its user interface is still solid, and it offers several online tutorials, but beginners may encounter complexities with advanced reporting or inventory management.

- While Accounting knowledge can be helpful, Xero’s user-friendly interface and support tools make it accessible for anyone to manage their finances effectively.

- †Invoice limits for the Early plan apply to both approving and sending invoices.

For banks without automated feeds, there’s the option to upload PDF bank statements from supported institutions, ensuring accurate financial records are maintained. This platform is a feature-rich and user-friendly accounting solution suitable for businesses of all sizes. Its simple setup process, intuitive interface, and customizable dashboards make it accessible for both experienced accountants and those new to managing finances.

Take back your time by automating manual accounting tasks and preventing errors

- You can also do this on behalf of your employees through your web browser.

- Xero used to offer strong customer support, and while there are still a ton of great support resources available, getting in touch with an actual representative is a lot more difficult.

- The platform also allows you to set up automated payment reminders, which are sent to customers at intervals you choose, helping to reduce late payments.

- Simplify payroll, track inventory, and manage your workload on the go.

- Xero’s user interface is not as polished as QuickBooks’, and I found it harder to navigate.

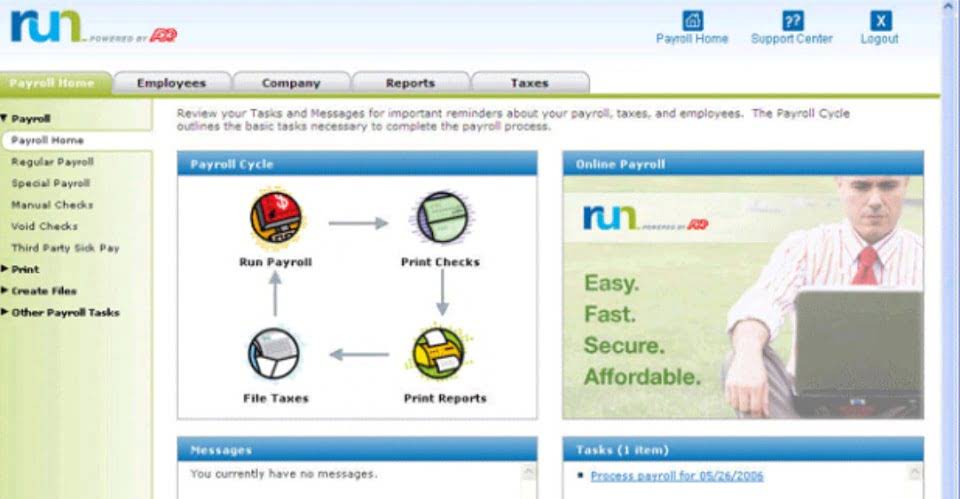

Xero and QuickBooks also offer mileage tracking, inventory management (Xero requires an additional inventory plan) and project tracking. https://hd-guard.com/blog/2024/11/12/understanding-and-managing-temporary-accounts-in/ When it comes to managing company finances, few platforms are better than Xero and QuickBooks. You can import data from another accounting system in bulk via CSV files once you’ve done the initial set up in Xero. That includes the chart of accounts, invoices, bills, contacts and fixed assets. For a smooth transition and best results, we recommend working with an accountant or bookkeeper, preferably one with Xero experience, when you make the move to Xero cloud accounting software. You run payroll directly from Gusto, and the transactions automatically show up in Xero.

Invoices & Estimates

The Early plan, tailored for small businesses, is available at $1 USD per month software xero (regularly $20), offering a 6-month savings of $114. The Growing plan, suited for expanding businesses, costs $2.35 USD per month (regularly $47), providing $267.90 in savings over 6 months. Xero provides strong security for your data, though I feel it falls short in 1 key area. First off, Xero offers 2-factor authentication, which has become a standard, extra layer of protection for online accounts. It does this through an authenticator app—either a third-party’s or Xero Verify, Xero’s own authenticator app. Upon logging in to Xero, you’ll be presented with some snapshots of your business’s financial health, such as your bank balance, owed invoices, cash in and cash out, upcoming bills, and more.